40+ How to calculate your borrowing capacity

Apply Now Get Low Rates. View your borrowing capacity and estimated home loan repayments.

Easyhome Review 2022 Comparewise

Buying or investing in a new property we have a variety of tools and calculators to.

. Calculate your borrowing capacity using this borrowing capacity. How much you have saved for a deposit plus your other savings. The borrowing capacity formula.

Common information needed to calculate your borrowing capacity. To calculate your borrowing capacity you may need to provide the following information to your lender. How much rental income you receive from properties.

How much you can afford to borrow depends on your. Free 40 Printable Loan Agreement Forms In Pdf Ms Word Even if this is not the only element taken into consideration. Home loan providers analyze income to determine how much a person can afford to pay for a mortgage.

This video will show you how the Bank goes about calculating how muc. Therefore you have to relate your personal revenue and your. While lenders all adopt this general framework there are differences in how they weigh and assess each dataset outlined below.

Lenders generally follow a basic formula to calculate your borrowing capacity. Gross income - tax - living expenses - existing commitments - new commitments - buffer monthly surplus. And not the gross income but the after-tax income.

Examine the interest rates. So on that same loan amount you would need to show a sufficient income to debt ratio to afford 11250 per annum or 93750 per month. Thus as part of calculating your borrowing capacity it is also wise to ask your lender what is going to be the interest rate for your loan.

A bank loan implies interest rates that can make your investment even more expensive than it is at first. You can get an estimate for this amount through a mortgage pre-qualification or for more certainty a mortgage pre-approval. The first step in buying a property is knowing the price range within your means.

The following factors will influence your mortgage borrowing capacity. Income and financial commitments. Compare Mortgage Rates Estimated Monthly Payments from Multiple Lenders.

Compare home buying options today. Compare home buying options today. The Maximum Borrowing Capacity Calculator provides you with an indication of how much Lenders are prepared to Lend according to your Income and Liabilities.

Everyones borrowing power for a home loan is different. When you borrow like this the bank will finance up to 70 of the amount of your project the remaining 30 must then come from personal contributions or money from relatives namely the. Typically borrowing power depends on your income deposit size living expenses credit score home loan type interest rate other assets and property priceLets take a closer look at each of these.

How much your annual salary is before tax. The first and most obvious factor is your income. Ad Find Out How Much You Can Afford to Borrow.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. The borrowing calculator is built using a. Your debt-to-income ratio is a metric that your loan officer will use to help determine how much youll be able to qualify for or how much house you may be able to afford.

Bcu Home Loan Borrowing Power Calculator Compare Offers Apply. OpenCorps Michael Beresford outlines how to calculate your borrowing capacity. To calculate your borrowing power we take into account a couple of key pieces of information your income and your debts.

How Lenders Calculate Your Borrowing CapacityClip from Episode 051 - Aaron Whybrow shares how different lenders calculate your borrowing power and the variab. Under tighter serviceability rules your bank may assess your borrowing power at principal and interest PI at 750 or even higher. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes.

Its worth looking at consolidating your debts and rolling them over to a. Your borrowing capacity is calculated by adding your gross income deposit size and credit score. 30360 is calculated by taking the annual interest rate proposed in the.

Include your and your co-borrowers. Borrowing capacity Self-financing capacity 3 or. Do you want to know how to calculate your borrowing capacity for residential home loans.

What is your borrowing capacity. Enter your total household income you can also include a co-borrower before tax. Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of.

Lenders generally follow a basic formula to calculate your borrowing capacity. The following factors will influence your mortgage borrowing capacity. Estimate how much you can borrow for your home loan using our borrowing power calculator.

How many applicants are applying for a mortgage. When it comes to existing mortgages lenders may either choose to use the actual repayments or use a higher assessment rate to calculate your borrowing capacity. How To Calculate Your Mortgage Borrowing Capacity.

Try Our Customized Mortgage Calculator Today. In most cases income from commissions bonuses overtime tips rental income and child support can all be counted toward your annual income. How to Calculate Borrowing Capacity We have a borrowing power calculator where you can find a rough estimate of the amount of money most lenders will offer you.

Excludes refinances from Bankwest and CommBank. Its one thing to find your dream home but whether you can afford the mortgage is another factor altogether. The borrowing capacity also called debt capacity is the maximum capacity that a company has to borrow from the bank and thus endanger its budget balance.

Factors that contribute into the borrowing power calculation. A mortgage pre-qualification is a rough estimate of your borrowing capacity to purchase a propertyIts calculated based on your basic financial information such as your. Lenders generally follow a basic formula to calculate your borrowing capacity.

Buying or investing in a new property we have a variety of tools. As an expat or foreign national your borrowing power will vary from a permanent resident. International Customers can call 675 305 7842.

2 days agoUnder the new initiative millions of federal student loan borrowers will be eligible for 10000 in loan forgiveness or up to 20000 if they received Pell Grants. Ad Compare Top 7 Working Capital Lenders of 2022.

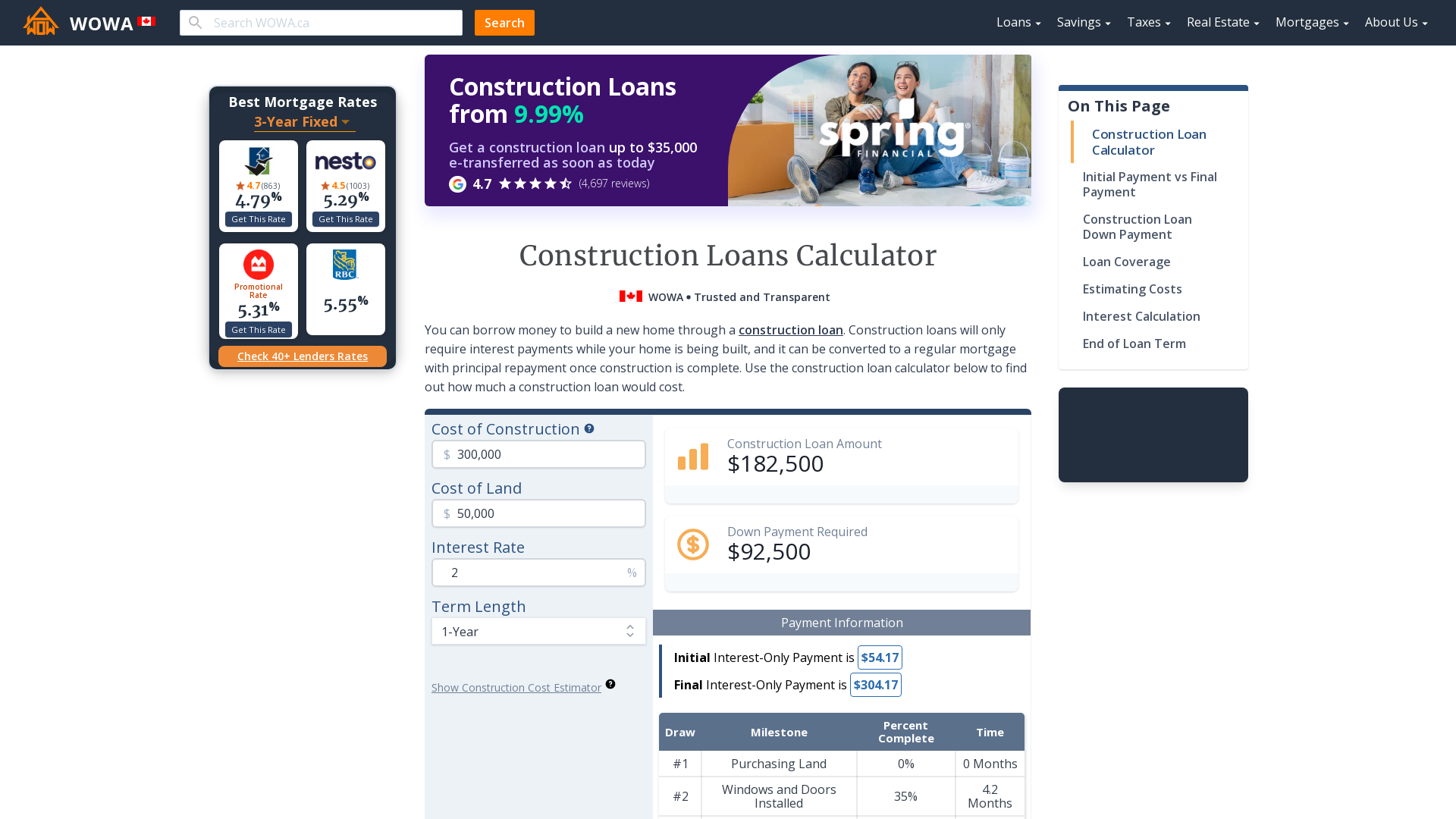

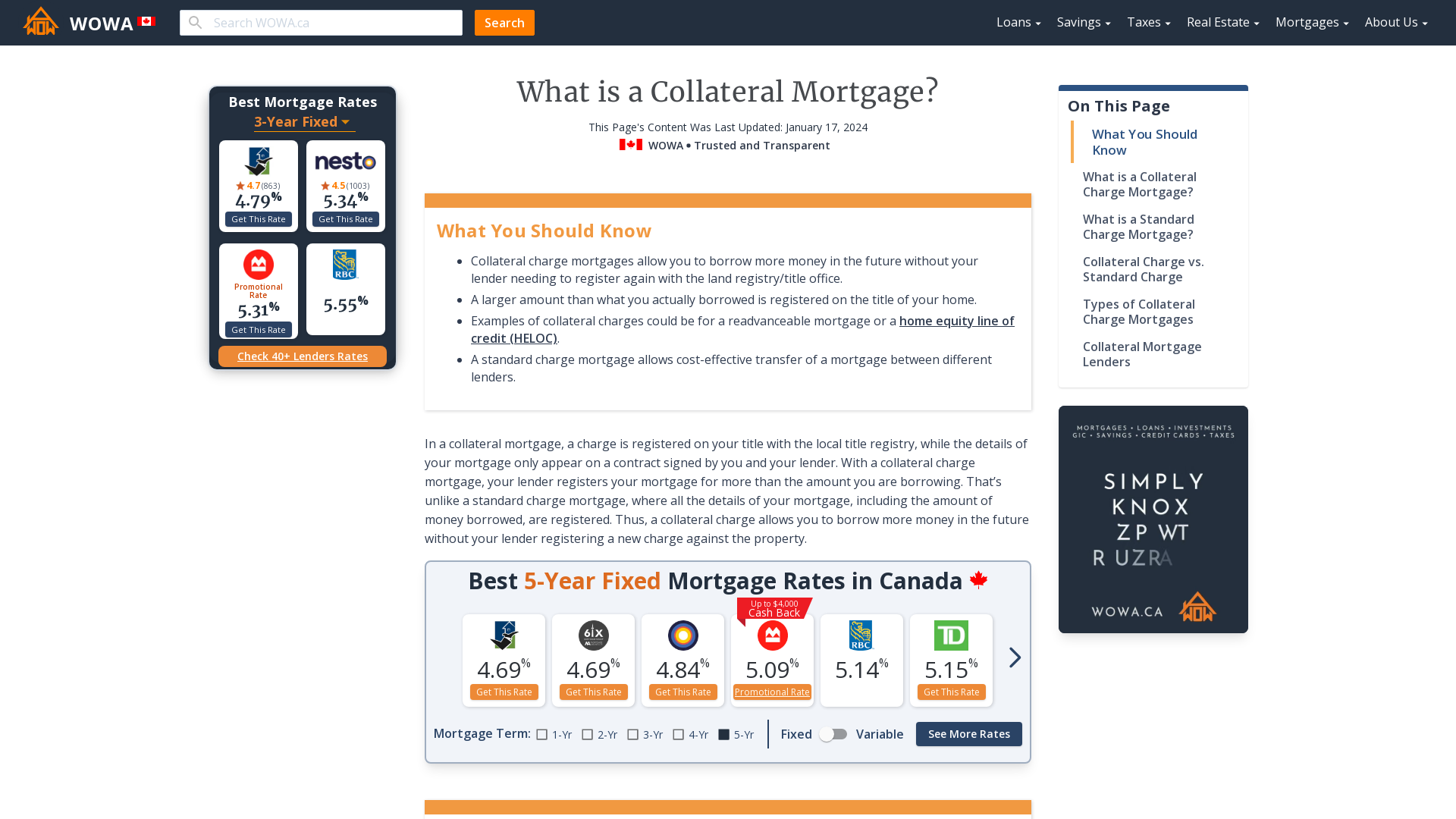

Construction Loan Calculator For Canadian Builders Wowa Ca

Instant Crypto Credit Lines Borrow From 0 Apr Nexo

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab

How To Use A Mortgage Calculator Comparewise

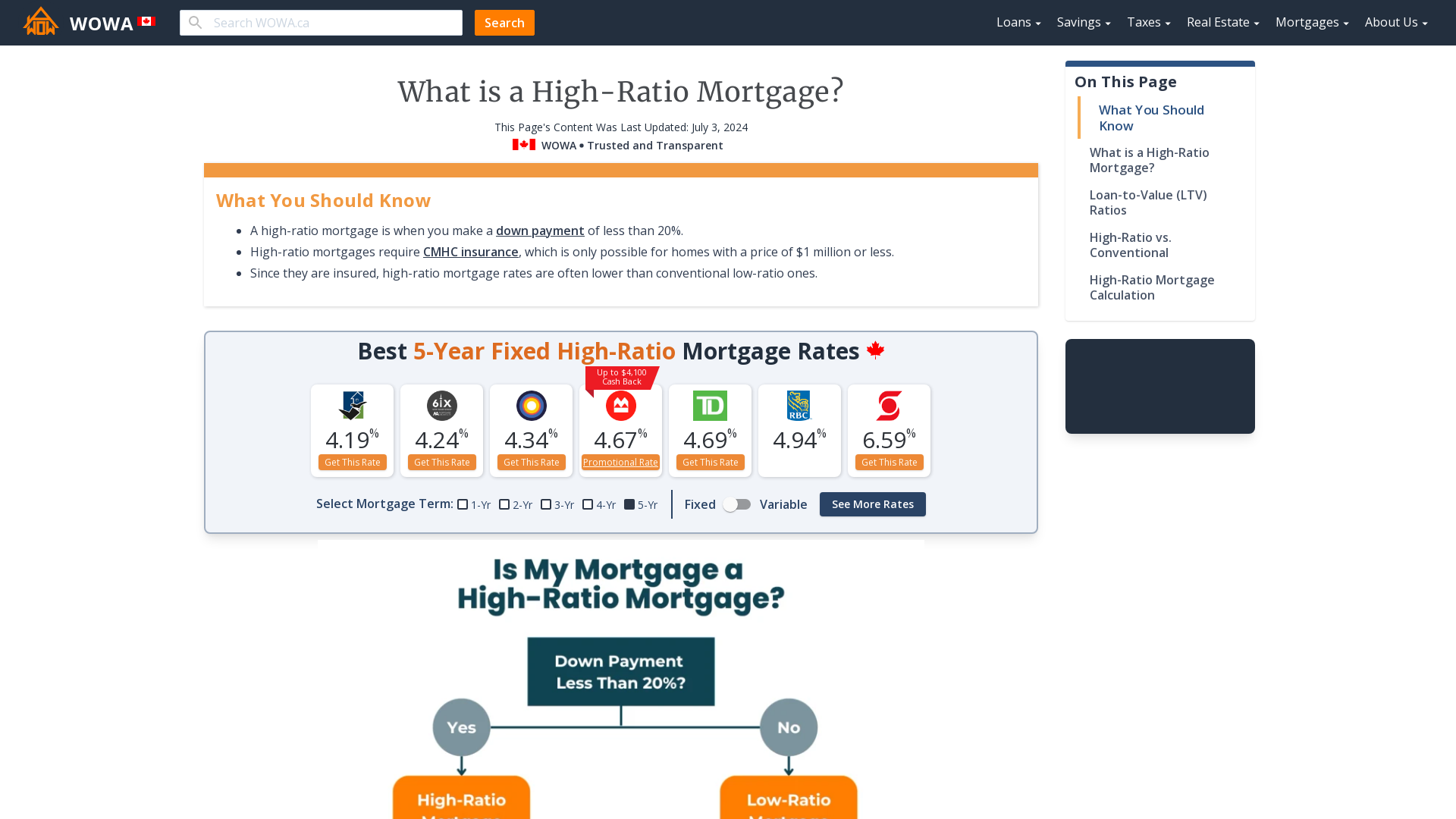

Mortgage Affordability Calculator Based On New Cmhc 2022 Rules Wowa Ca

How To Get A Mortgage With Bad Credit Comparewise

Instant Crypto Credit Lines Borrow From 0 Apr Nexo

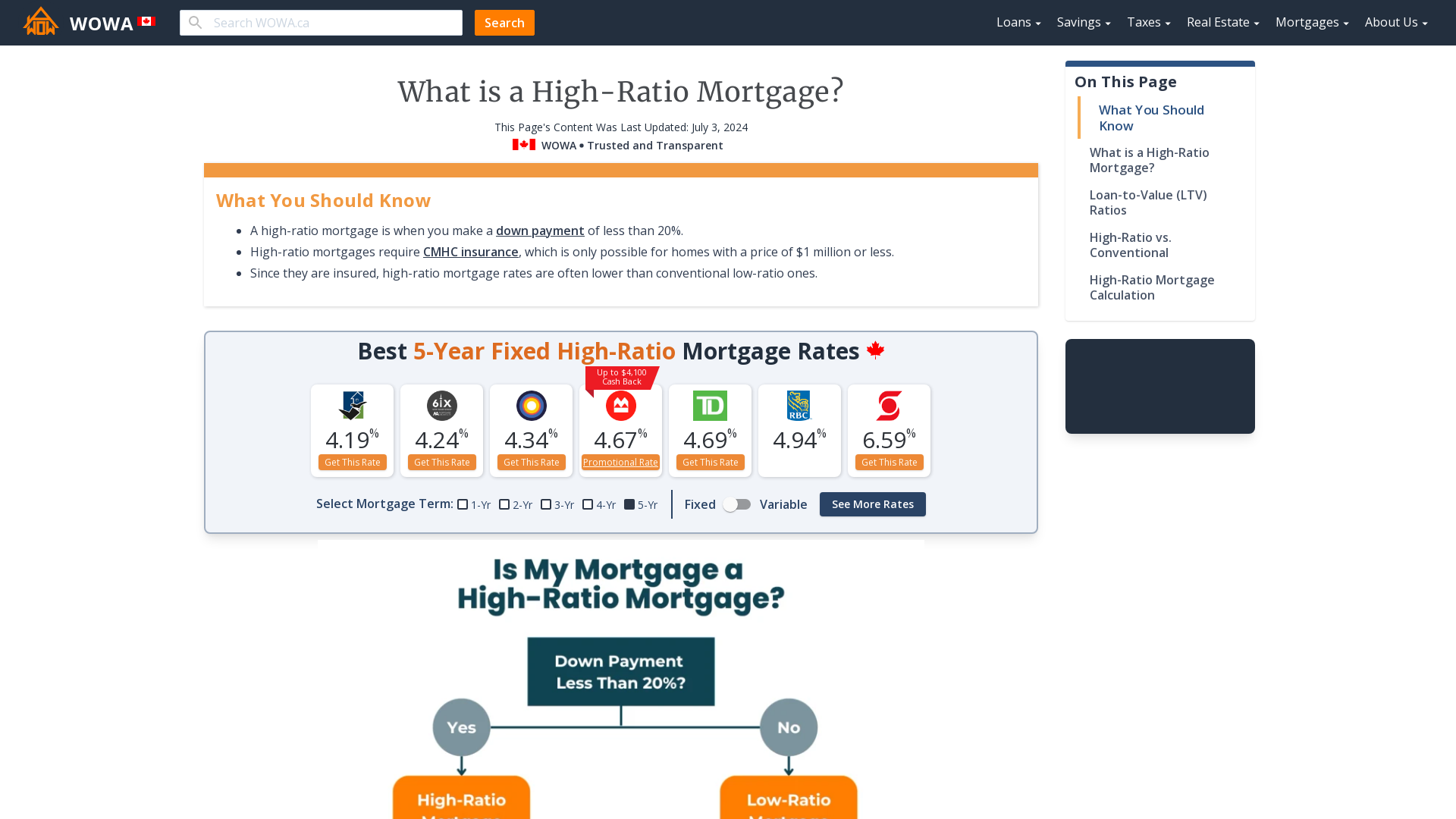

What Is A High Ratio Mortgage Pros Cons Wowa Ca

Jsqnt Gqgxdjfm

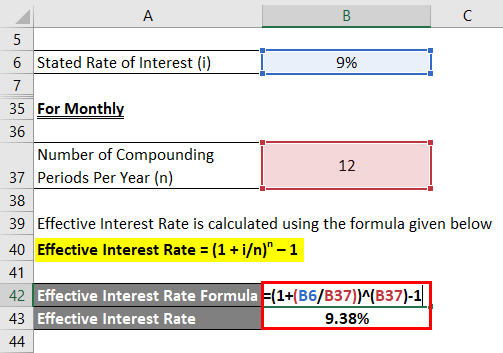

Effective Interest Rate Formula Calculator With Excel Template

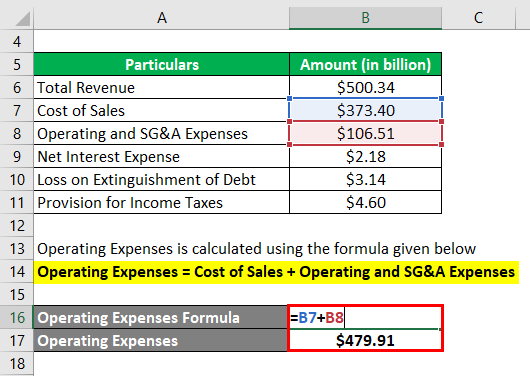

Profit Margin L Most Important Metric For Financial Analysis

Download Personal Loan Agreement Template Pdf Rtf Word Doc Wikidownload Personal Loans Contract Template Loan Application

What Are Some Of Ideas You Can Use To Pay Off Your Mortgage Quicker Quora

Mortgage Refinance Guide Procedure Costs Calculator Wowa Ca

Heloc Calculator Calculate Available Home Equity Wowa Ca

Borrowing Power Calculator It S Simple Finance

40 Free Loan Agreement Templates Word Pdf ᐅ Templatelab